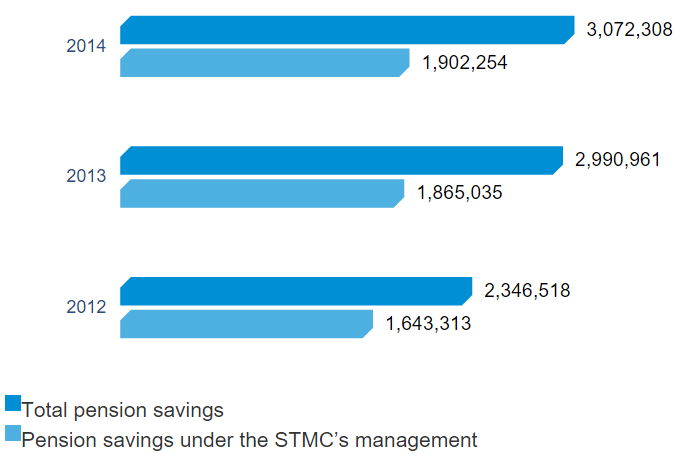

In 2014, Vnesheconombank was operating as the STMC in a challenging economic and geopolitical situation that resulted in the policy rate of the Bank of Russia skyrocketing from 5.5 to 17%, which led to a considerable decline in prices for Russian bonds. As a consequence, the three investment portfolios posted negative yields for the first time since Vnesheconombank had been acting as the STMC and PR STMC.

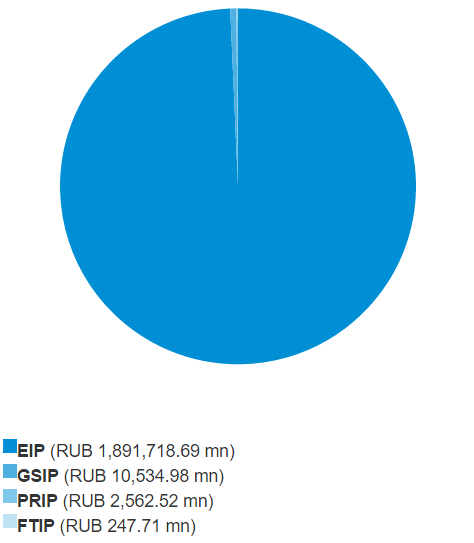

The yield of the Extended Investment Portfolio that accounts for 99.45% of total pension savings managed by the STMC remained positive. This result was achieved, among other things, due to the high level of the portfolio’s immunisation, with assets not marked to market accounting for more than 65% in the portfolio.

The negative yield on the GSIP and portfolios of the PR STMC was due to the inability to immunise them in 2014 by acquiring instruments that are not marked to market, and by depositing portfolios’ funds with commercial banks, including due to the small size of the PR STMC’s portfolios and lack of interest from commercial banks to take such small amounts on deposit.

Return on investment of pension savings

|

2013 |

2014 |

| STMC’s portfolios |

| Extended Investment Portfolio (EIP) |

+ 6.71% |

+ 2.68% |

| Government Securities Investment Portfolio (GSIP) |

+ 6.90% |

- 2.05% |

| PR STMC’s portfolios |

| Payout Reserve Investment Portfolio (PRIP) |

+ 5.52% |

- 2.96% |

| Fixed-term Investment Portfolio (FTIP) |

+ 5.51% |

- 2.69% |

In order to manage liquidity and increase the return, in 2014, the EIP pension savings were mainly invested in corporate bonds and deposited with commercial banks:

- RUB 128.9 bn of EIP funds were invested in non-government bonds, with their share in the portfolio rising from 36.36 to 37.95%;

- RUB 266.99 bn of EIP funds were deposited with commercial banks, with their share in the portfolio rising from 7.02 to 14.86%.

Although investment opportunities materially shrank in 2014, the STMC still remains the key player in the long-term investment market and a source of support to the Russian economy. Following resolutions by the Russian Government, in 2014, Vnesheconombank invested about RUB 55 bn of EIP pension savings in bonds of companies that implement infrastructural projects. The total amount of bonds issued by infrastructural companies in the STMC’s investment portfolios, including investments of 2014, exceeded RUB 401.92 bn.