In 2014, Vnesheconombank completed the buyout of bonds under the Programme for Investment in Affordable Housing Construction and Mortgage Loans in

Vnesheconombank’s Programme for Investment in Affordable Housing Construction and Mortgage Loans in

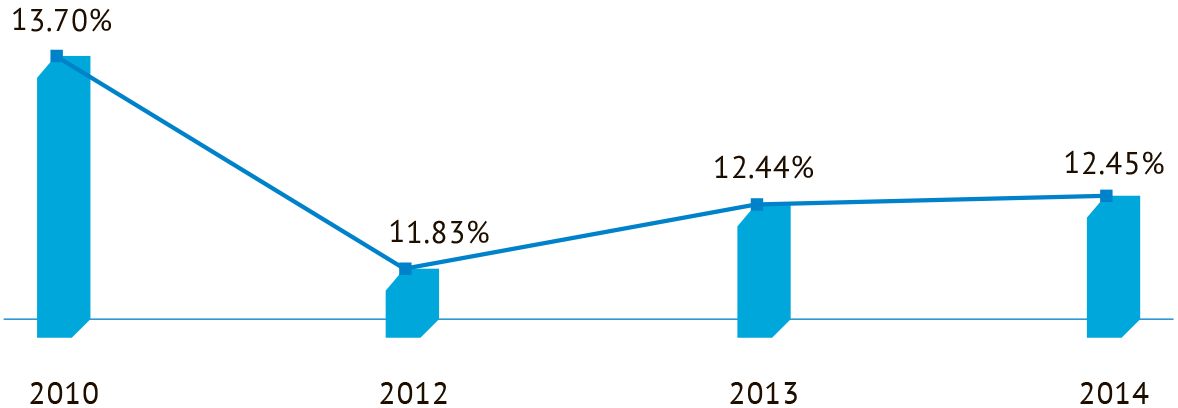

Since the Programme's approval in early 2010, average weighted interest rates on rouble-denominated housing mortgage loans in Russia have declined from 13.7 to 12.4% in the primary and secondary markets. When banks participating in the Programme were actively issuing mortgage loans in early 2012, rates went as low as 11.8%.

As part of the Programme, Vnesheconombank bought 32 mortgage-backed bonds for a total of RUB 91.7 bn. In line with the Programme’s terms, two thirds of them were bought using pension savings under the STMC’s management and one third using the Bank’s own funds. The offerings of mortgage-backed bonds made under the Programme were arranged by a subsidiary of Vnesheconombank Group, VEB Capital. In 2014, VEB Capital successfully discharged its commitments by issuing 18 mortgage-backed bonds for a total of RUB 49.356 bn.

Programme: Russian Family Housing

Vnesheconombank, the China Development Bank (CDB), AHML and VEB Asia signed a memorandum of understanding in the presence of Russian President Vladimir Putin and the President of the People’s Republic of China Xí Jìnpíng in Beijing in 2014. In the document, Vnesheconombank and CBD reiterate their interest in the financing of social housing programmes of AHML and their commitment to interact with the agency as financial advisers and potential investors.

The Russian Family Housing programme run by AHML is included in the government’s crisis management plan of priority actions to ensure sustainable economic development and social stability in 2015. 25 mn square metres of value housing are planned to be built under the programme until mid-2017. These apartments will be offered at a price 20% below market prices. AHML’s financing requirements reach up to RUB 135.5 bn, with loan maturities up to 25 years.